monobank platinum Cards

For personal and credit funds

Card benefits

500 UAHOpening

Plus free card update

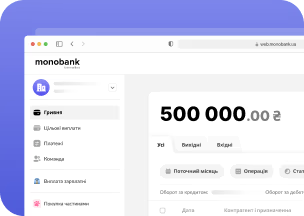

Credit LimitUp to 500,000 UAH

To cover all your needs

Milescashback alternative

To redeem tickets

MedicineFrom Medkit

Unlimited online consultations

24/7 concierge service

Whatever you need - our 24/7 support team has your back.

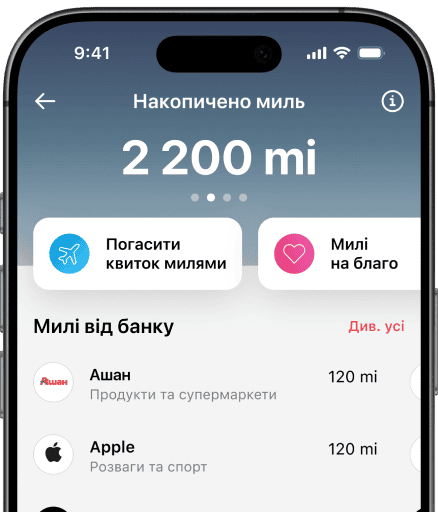

Miles rewards program

Get more for your platinum purchases:

11 miles for every ₴1,000 spent

Earn and redeem tickets with miles:

1 mile = ₴1

Using miles

in the app

Earn miles

Make everyday purchases with your card

Redeem tickets with miles

Choose any airline ticket worldwide or train tickets from your statement to redeem with miles

Money flies to your card

In a few taps, ticket costs are credited to your card

Comfort in

your travels

Travel comfort services

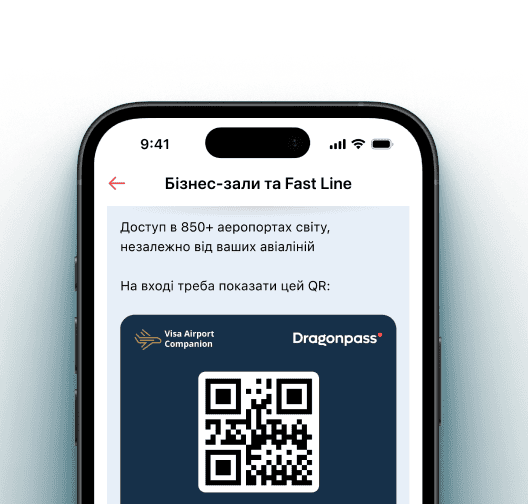

Business lounge access

Access at 850+ airports worldwide, regardless of your airline. You can always check available services in your card settings

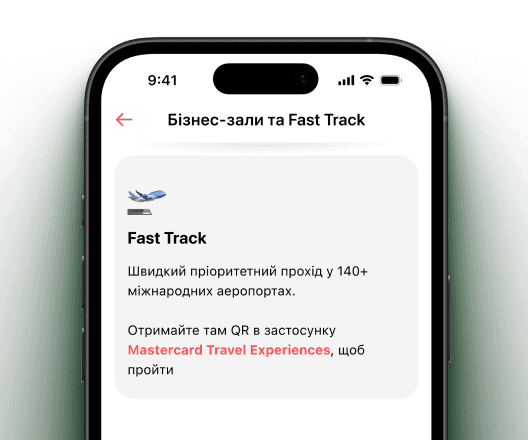

Fast Line / Fast Track

Service that lets you fast-track all formalities at 140+ airports worldwide: check-in, passport and customs control

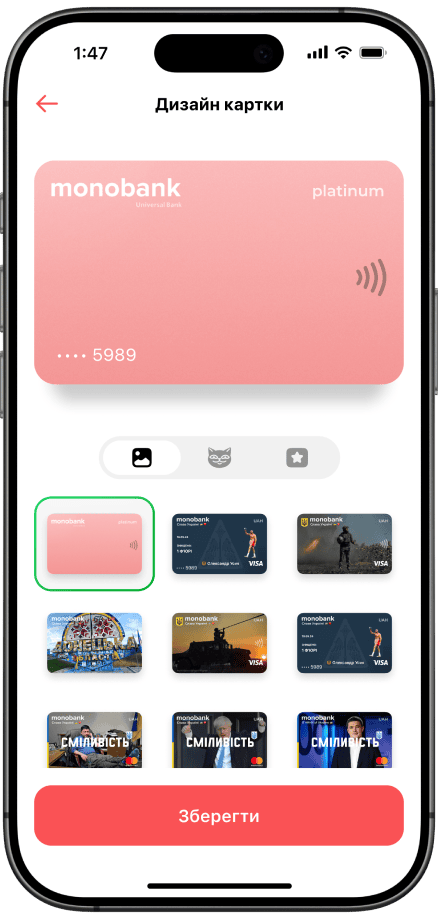

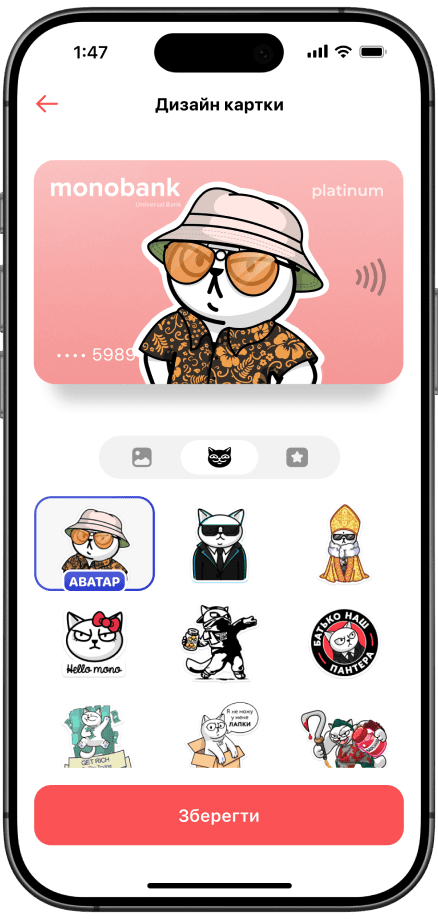

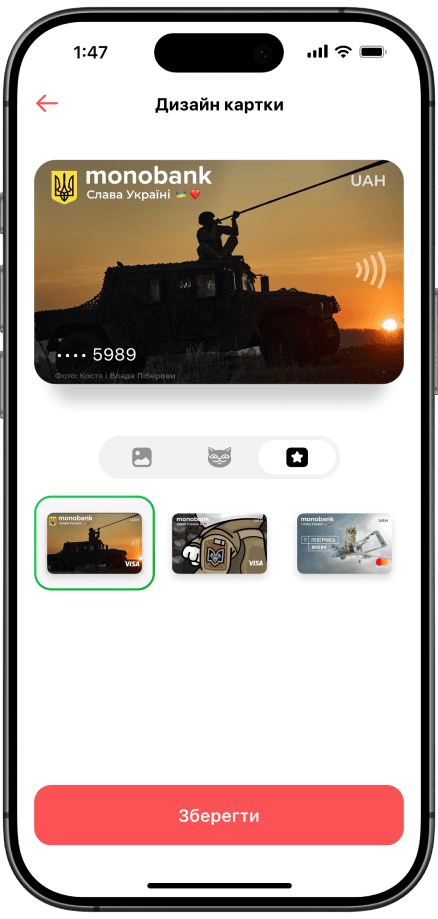

Unique card design for Apple and Google Pay

Add avatars or choose available skins

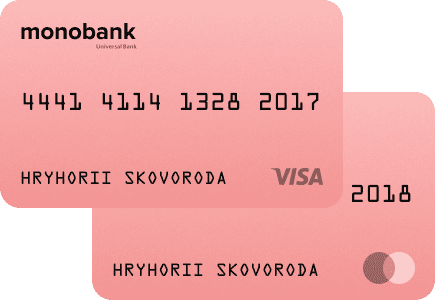

1 account

2 cards

∞ possibilities

We created platinum cards with Mastercard World Elite & VISA Infinite so our clients get maximum privileges

You get two cards from different payment systems — physical and virtual. Each comes with its own perks and discounts

But wait, there's more

SWEET.TV

Free access to premium package

Bolt discounts

-50% on rides to/from train stations with Bolt taxi

Commission-free cash withdrawals

Free cash withdrawals abroad from personal funds up to ₴5,000 per month

Free insurance

Travel insurance policy

Kyiv station lounge

Free lounge access at Kyiv Central Station

Car rental discounts

Up to -15% on SIXT, -10% on Rentalcars, up to -35% on Avis

Credit Calculator

Calculate your total credit cost

FAQ

monobank card

No fees, done in minutes